Schweitzer Mountain, Idaho Joins the Ikon Pass

Idaho’s largest ski area becomes Ikon’s 45th destination

Schweitzer Mountain Resort, the largest ski area in Idaho, will join the Ikon Pass for the 2021-22 ski season. Ikon Pass holders will receive seven unrestricted days and Ikon Base Pass holders will receive five days subject to holiday blackouts. Ikon Session Pass holders will be able to use any or all of their four days at Schweitzer.

The 2,900-acre resort becomes the Ikon Pass’ 45th destination and its first in Idaho. The addition softens Alterra’s decision to significantly reduce Base Pass access to Crystal Mountain in neighboring Washington beginning next season. The Idaho resort is already closed for the 2020-21 ski season, so 2021-22 passholders will not have any advanced access (they can still access select Alterra-owned resorts until they close).

Its inclusion on the Ikon Pass is an enormous milestone for Schweitzer, which despite its large size and considerable infrastructure has little national name recognition outside the Pacific Northwest and Upper Rockies. The ski area recently launched a rebranding to mark its evolution into an all-seasons resort.

Here’s a bit more about what this partnership means, both for Ikon Pass holders and for Schweitzer:

Ikon addresses its Base Pass problem

When Alterra bought Washington’s Crystal Mountain in 2018, they dropped the ski area onto the unlimited tier of the $599-ish (at the time) Ikon Base Pass. Perched just over 80 miles from Seattle, Crystal has long been an unsung giant of North American skiing: 2,600 acres on a 3,100-foot vertical drop, all topped in 486 inches of average annual snowfall. It’s the largest ski area in Washington. Still, it has few on-mountain beds, and most skiers day-trip to the mountain, which sits at the end of a long two-lane road.

The combination of a New England state’s worth of terrain, ultra-cheap season passes, and proximity to an increasingly affluent town of active-lifestyle strivers quickly turned combustible. By early 2020, the place was regularly overrun on weekends. Alterra eliminated walk-up day tickets (a novel idea in that pre-Covid ski Paleolithic), but skiers had clearly oversubscribed. When Alterra announced its 2021-22 Ikon Pass suite in March, Crystal had been downgraded to the five-days-with-blackouts tier of the $729 ($649 for renewing skiers) Base Pass. Anyone who wanted unlimited Crystal would have to buy the full $999 ($899 renewal price) Ikon Pass.

“We need to be willing to break our own paradigm, in a positive way to disrupt our own way of doing business,” Alterra CEO Rusty Gregory told me on The Storm Skiing Podcastlast month. “And I think it’s working, because I’ve received a bunch of letters that say, ‘I hate you for restricting my Ikon Pass, and I love you for making sure my experience is going to be a good one.’”

Adding five Schweitzer days to the Base Pass doesn’t solve Alterra’s Northwest problem, but it does soften it, giving the region’s skiers another drivable option for a multi-day trip. Schweitzer sits around six hours from Seattle, making it the third large ski area in the region – after Red and Mount Bachelor – to join Ikon in the past year. And passholders still have easy access to Boyne’s Summit at Snoqualmie – an awkwardly named four-mountain ski circus that includes the outstanding and unsung Alpental – and Cypress, just over the border in British Columbia (whenever the border reopens).

Meanwhile, expect Alterra and its partners to continue tinkering with Base Pass access. Before limiting Crystal, the pass had moved Jackson Hole and Aspen to a $100 Plus Pass tier for the 2020-21 ski season. Two weeks ago, Big Sky kicked all Ikon Pass holders off its tram (skiers will be able to pay extra to access it). Adjustments move both ways, however, and Alterra bumped Sugarbush and Stratton from five-day Base Pass mountains to unlimited-access-with-blackouts mountains after Vail dropped Mount Snow and Okemo onto the unlimited tier of its Epic Local Pass in 2019.

Idawho?

All the glory in Western skiing seems to go to a handful of pre-sorted winners in Colorado, Utah, and around Tahoe, with a nod to a few Jackson Hole/Big Sky-caliber giants scattered elsewhere. Ask most skiers outside of the immediate area to list every resort they can think of in Idaho, and most will quickly name Sun Valley and then stand there awkwardly while they try to remember if Taos is in Idaho or Montana.

But Idaho is a rich ski state. It just hasn’t quite become what it could be, and Schweitzer has long been the most frustrated striver of this bunch. Per Skibum.net, my favorite ski-area description site:

Schweitzer is a bigtime ski area … Trying to become a Sun Valley/Park City/Telluride destination, but not quite there yet. Liftlines can be dreadful; some equipment has been updated but it seems like Schweitzer is the gawky teenager that isn’t quite comfortable growing into adulthood. … Nice, big ski area, needs to grow into its phenomenal potential.

It’s trying. The mountain has built a modern lift fleet that includes a trio of high-speed quads and an express six-pack. Last year, Schweitzer announced a decade-long, $85 million investment that will include a new facility tailored toward beginners and intermediates. It’s recent brand overhaul was intended, in part, to orient the resort toward “the future we aspire to create.” Still, the ski area draws around a quarter million annual visitors, a fraction of the 1.6 million that similarly sized Breckenridge, Colorado is estimated to clock annually.

Joining Ikon Pass should considerably amp up Schweitzer’s profile and status, turning it into a map dot in the national megapass landscape. Anyone who’s witnessed the before-and-after liftlines and crowds of an independent-turned-Ikon mountain understands how inclusion on a pass ratchets both of those things higher.

Beyond Schweitzer, the Ikon Pass partnership is good for Idaho skiing in general. Outside of Vail’s Epic Pass partnership with Sun Valley, the Colorado-based megapasses have until now ignored the state. Indy Pass seized this vacuum, moving aggressively to amass a roster of five Idaho partners, many of them quite impressive: Brundage (2,000 feet of vertical, 1,500 acres), Silver (2,200 vert/1,600 acres), Tamarack (2,800 vert/1,100 acres), Soldier Mountain (1,425 vert/1,150 acres), and Pomerelle (500 inches of annual snowfall). For decades, Idaho has been the snowy northern secret of U.S. skiing. Enjoy that while it lasts.

This is a major ski destination

Schweitzer is huge by almost any measure. At 2,900 acres, it’s bigger than a roster of far-more-famous resorts, including Jackson Hole, Snowbird, Copper Mountain, Alta, Sun Valley, Deer Valley, Telluride, and Beaver Creek. It will become the 12th largest ski resort on the Ikon Pass, after Squaw Valley-Alpine Meadows (6,400 acres), Big Sky (5,800), Mount Bachelor (4,318), Lake Louise (4,200), Red (4,200), Mammoth (3,500), Snowmass (3,362), Sunshine (3,358), Revelstoke (3,121), Winter Park (3,000), and Steamboat (2,956, though that is slated to increase by 600 acres).

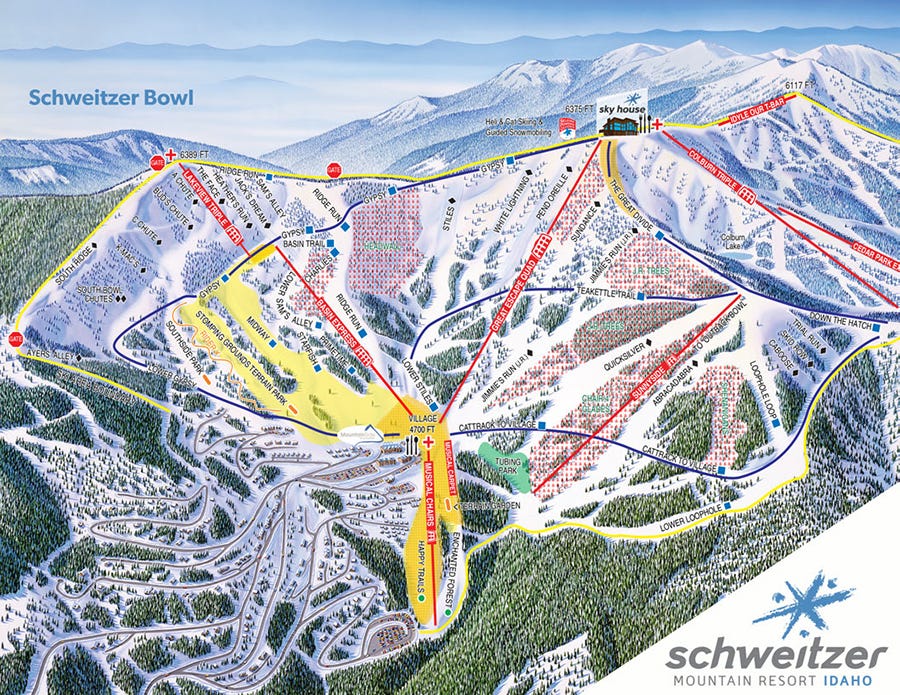

Here’s the trailmap:

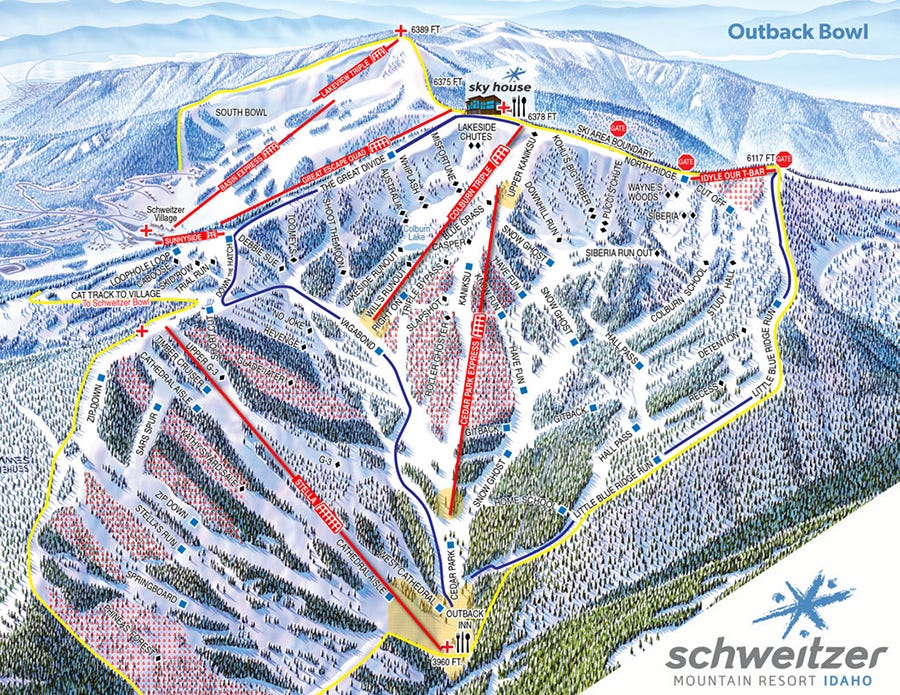

If you’re still not convinced, here’s the rest of the trailmap:

So what’s left as the megapass conquers the world?

After years of megapass consolidation, Schweitzer was one of the last large, unaffiliated ski resorts in North America. If you’re wondering how many other nearly-3,000-acre megaresorts are perched forgotten in the snowy hinterlands, well, there aren’t many.

But there are a few. Utah’s Powder Mountain is an 8,500-acre snow Narnia (only 3,000 of those acres are lift-served). British Columbia’s Silver Star (2,500 vertical feet and 3,269 acres); Whitefish, Montana (2,353 vert/3,000 acres); Big White BC (2,656 vert/2,800 acres); and Bogus Basin, Idaho (1,800 vert/2,600 acres) are all megapass candidates. I doubt Vail is interested in any of them except perhaps Powder Mountain, which carries a patina of exclusivity and would help balance the Epic Pass’ Utah scarcity (just Park City and limited Snowbasin days), with Ikon’s killer Wasatch lineup of Alta, Snowbird, Brighton, Solitude, and Deer Valley. An Ikon or Mountain Collective partnership with Whitefish and/or Silver Star is fairly easy to imagine. Indy Pass would be lucky to have any or all of them.

After its aggressive growth since debuting in 2018, it’s hard to spot holes in Ikon’s North American lineup. A smart growth play would probably be to buy a small resort in population-rich North Carolina, to entice skiers in that increasingly wealthy state into Western Ikon vacations. The same template could apply to Western New York or the Midwest, where the pass’ only presence is two Boyne mountains, which are among the region’s best, but are just 26 miles apart and tough to access for anyone who does not already live in Michigan’s Lower Peninsula.

Ikon’s next real frontier is probably Europe, where it has just one partner – Zermatt – to Vail’s 26 (though this access often has weird and confusing terms attached to it). With most of the continent’s skiing shuttered for the entirety of the 2020-21 ski season, this may be an optimal time to kindle new partnerships, as devastated businesses look to rebuild for a post-Covid world.

Posted from The Storm Skiing Journal